Vitalik Butherin, the man behind Ethereum, presented the scalability trilemma as follows: a blockchain faces a trade-off between decentralization, scalability, and security.

Traditional money transfers through banks are apparently safe and scalable – the system can handle billions of transactions a day. They are, however, totally centralized, which makes it possible for the West to kick a few Russian banks from SWIFT. Bitcoin, on the other hand, is safe and decentralized. Its only problem is that transaction time and price both depend on the network’s congestion. Since a single transaction can take a few hours and cost up to 70 dollars (last year’s bull run all-time high), Bitcoin is not exactly what one would call scalable.

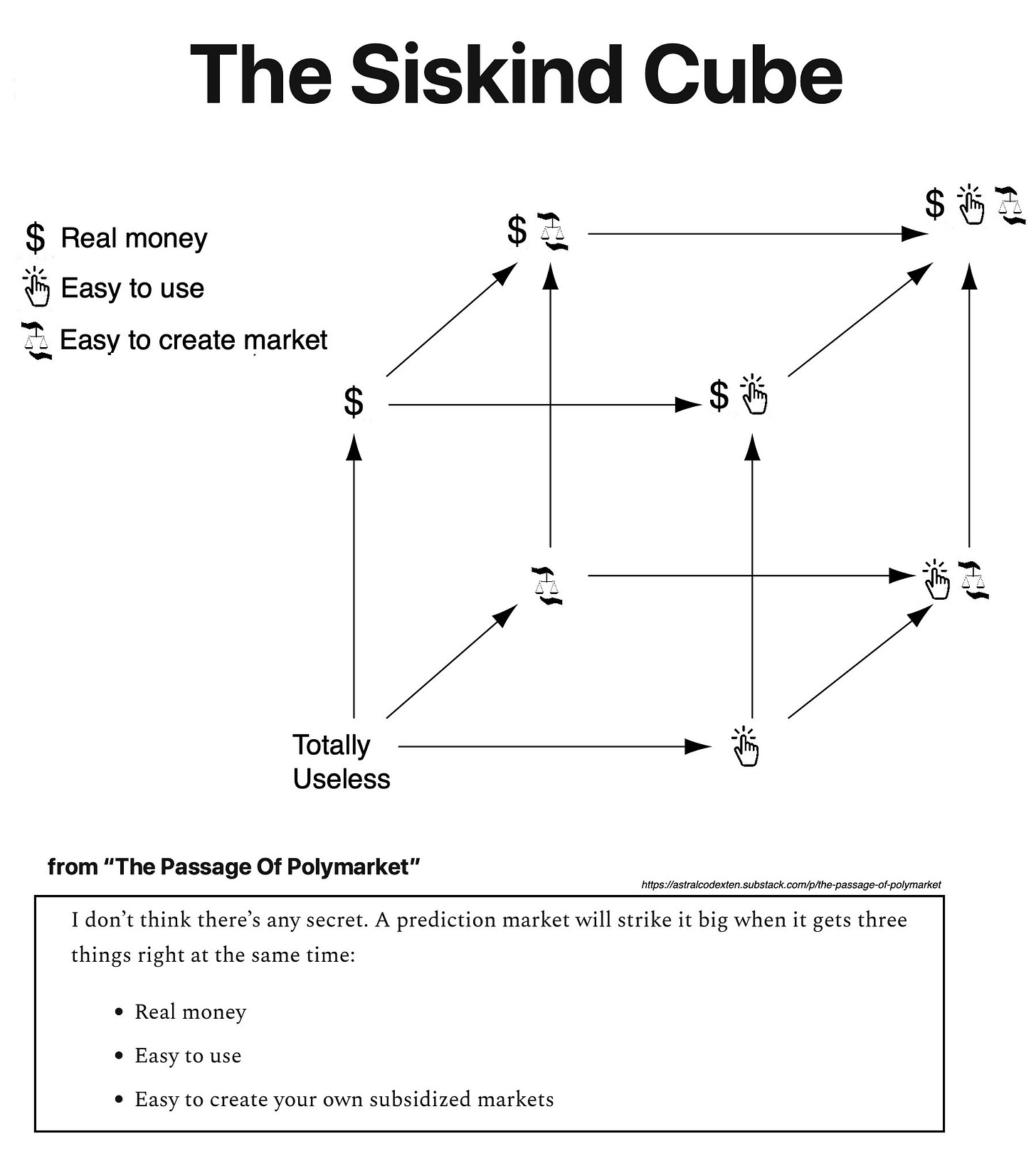

A few weeks ago, Gustavo Lacerda and Nuno Sempere designed the Alexander cube, which Scott discussed a few weeks ago on his weekly Mantic Monday post on Astral Codex Ten. Alexander’s cube suggests that prediction markets are also facing a tricky trilemma:

If a few years ago, Vitalik’s blockchain trilemma captured the community’s interrogations about cryptocurrencies, then the Alexander cube summarizes the current preoccupations about prediction markets. A great strength of Lacerda and Sempere representation is that it instantly shows what seems to be the end goal - a real-money platform, where anyone can create and participate in the market easily.

Now, one can notice that all the active platforms on Alexander’s cube have a centralized oracle (keyword here being active). It means that for each market, only one person or organization, usually called the oracle, is arbitrarily able to state the market’s outcome.

PredictIt, Metaculus and Polymarket are all based on an in-house oracle. It is also not possible for users to create markets on either of these platforms yet. It is unfortunate. Sure, Polymarket often posts markets suggested by their Discord server members; but If we compare it to what prediction markets were supposed to be in the first place, these platforms are like thinking you’re going to a buffet restaurant and ending in a single-meal kitchen. Being able to bet on NFL games and Ethereum prices is all fun and games, but we are far from being able to enjoy the radical possibilities that could be opened by user-made markets. All the promises that prediction markets held - the weather hedging, ingroup bets, the assassination markets - they all remain wet dreams. Unless…

Enters Manifold. Manifold Market, as we know, tackled the issue by using a market creator as the market solver dynamic. If I was suspicious at first, this K.I.S.S. system is surprisingly robust. The platform has gained serious traction, at least in the niche community of people interested in prediction markets. If ever the Manifold dev team, which is so far doing an excellent job so far, plan on going real money while keeping the market creator = market solver mechanics (a very long shot for now), I can see two phenomena emerging:

The mechanics will deter some people from participating, as they are scared to bet on anon's arbitrariness.

Some market creators will become brand names, recognized and trusted by the community, with their markets attracting more volume than others.

Now, these two speculative trends are far from being mutually exclusive. If the implementation is well done, then the initial #1 effect would progressively get offset by #2, even though it would represent a significant activation barrier to the use of the platform in the first place.

Its advantage regarding market creation makes Manifold only half-decentralized. Decentralizing the oracle is the high-risk, sky-high trickiness part, where projects go to die!

A promising way of decentralizing the oracle part is consensus-based resolution. This is what Augur, also represented on Alexander’s cube, attempted to achieve. Attempted only, though: despite still being operational, the project is now brain-dead. There is no active market on the platform, development has come to a halt and marketing has stopped. Explaining what caused Augur’s demise would require a post of his own (that I will probably work on in the very near future), so let’s discuss Augur’s ambitions instead.

The core idea behind Augur was to allow anyone to contribute to the resolution of markets using reputation-based mechanics. If the outcome of a market was disputed, an auction-like process would start where users stake literal reputation tokens (REP). The resolution process is designed so that the untruthful sources lose their reputation tokens, while the truthful participants see their REP bankrolls increased.

On paper, Augur has it all. Market creation and participation are open to everybody. Augur’s consensus-based system literally makes lying expensive. The protocol being on-chain, nobody could take it down - no censorship, no regulatory constraints. It was backed by an amazing team who did not lack money nor hype - in 2015, they raised more money than Oculus Rift in 3 days of crowdfunding campaign.

Yet, Augur still failed, not without having the team try to turn the ship around many times with the successive launch of v2 and Turbo.

Knowing that Augur generated such interest and such hopes, it is strange to see that decentralized oracles are totally ignored in Alexander’s Cube. I do not believe it was an omission from Scott Alexander, Lacerda and Sempere: I think it reflects the current state of the community.

Augur’s proposal was to bring a nuclear reactor to a high school science fair. After having decided (possibly unfairly) that Augur looked complicated and clumsy and glitchy and expensive, the community tacitly agreed on the fact that all the hype surrounding decentralized platforms was not worth it. When Augur’s team released Augur Turbo in the middle of last year, with low fees and instant resolution, it was already too late. People agreed that centralized platforms were okay for our current use cases - betting on elections and sports games.

If you're a regular user casually wanting to bet a few bucks on the NBA, decentralization is the last thing you should care about. It might even make the process less smooth, increasing the platform’s activation barrier. Perhaps even prediction market pundits are okay with prediction market platforms being centralized prediction markets if that’s a compromise for prediction markets to get the traction they currently have. There is nothing wrong with that. Polymarket and Predictit are doing a cool job.

But one cannot refrain from asking where are the weather hedging markets, the highly speculative geopolitical markets, the shared house gardening markets or even the assasination markets they promised us.

We could have so much more.

If we still think prediction markets have the potential to be impactful, then we need to face the fact that total decentralization is the only thing that can make it more than simply sport & crypto-price & insert here generic world event betting platforms. A little decentralization is already what makes Manifold markets so much more exciting.

I was unaware Augur had died. But just checking their site, I see that 2 hours ago they made what might be their final blog post:

https://www.augur.net/blog/augurdao/

Hi Tao! Austin from Manifold here. Thanks for writing this up -- I think you did a great job explaining the benefits of a decentralized oracle system! I'm personally very interested in ways to adjudicate resolutions beyond "creator decides", though I don't speak for all of Manifold; James and Stephen lean more towards caveat emptor as where the buck stops. There may be some middle ground here, eg where the default is "creator decides" but creators can delegate to the community oracle.

We'd definitely like to get Manifold to a place where our money feels "real" as well. Crypto is the most obvious solution, but every crypto implementation so far fails the "easy to use" test of the Alexander cube. Polymarket blocks US users; every crypto prediction market requires you to figure out how to onboard money into a personal wallet (FTX is the exception, but they have very few markets atm). I think a managed wallet might be the answer (https://future.a16z.com/missing-link-web2-web3-custody-wallets/) but we have a few other ideas in this space such as cash-prize tournaments and charity prediction markets.

Finally: it seems like Polymarket's markets are no longer resolved by the platform, but rather use the decentralized UMA oracle? Nuno goes more in-depth here: https://forecasting.substack.com/p/2022-02?s=r . It's quite exciting, and I'm tempted to see if a similar mechanism could work for us as well!